Invoice / Retail Invoice

Invoice is an commercial document given at the time of sales of your product that indicates that your product is sold & your customer has to pay back the money for it.

Retail Invoice is an commercial document requesting for immediate payment from retailer on purchase.

Page Contents

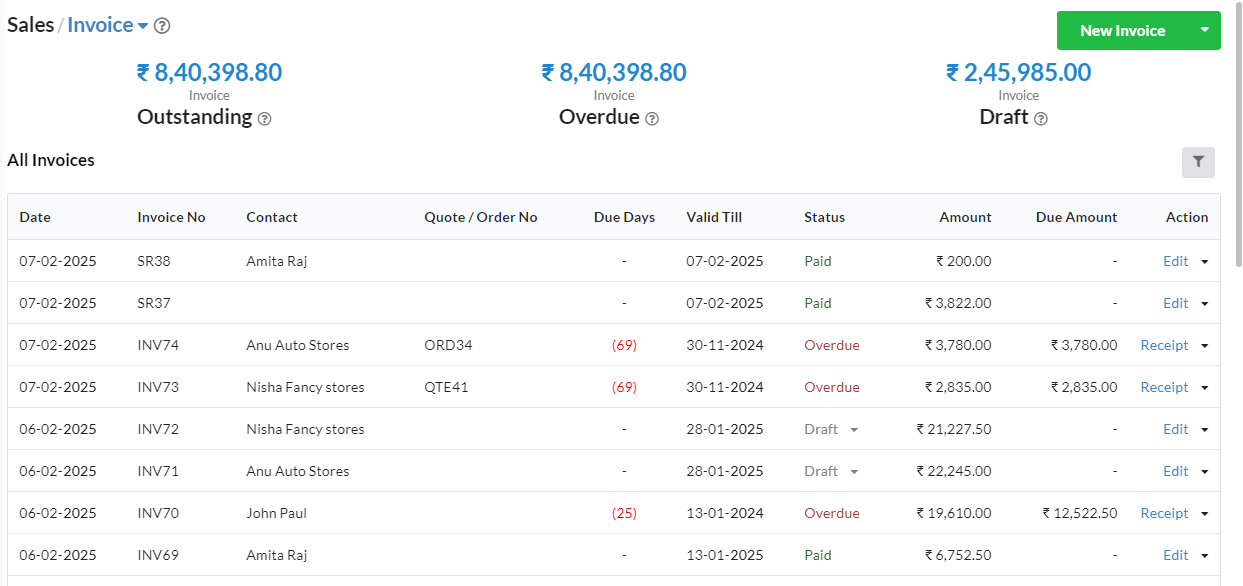

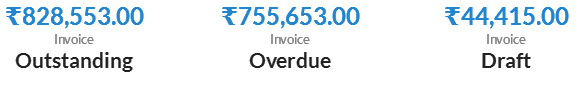

Invoice Listing

All Invoices will be listed in Sales > Invoice. You can filter and view the list of Outstanding, Overdue and Draft Invoices with it total amount that was invoiced. On clicking each will list the respective invoices.

All your invoices will be listed with its Date, Invoice No, Contact, Due Date, Status, Amount, Due Amount.

You can rearrange the invoice list based on all these column headers.

You will also have the filter option to search invoices based on the name, status & date range.

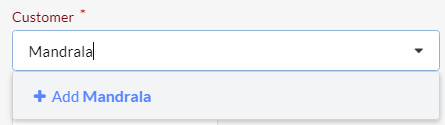

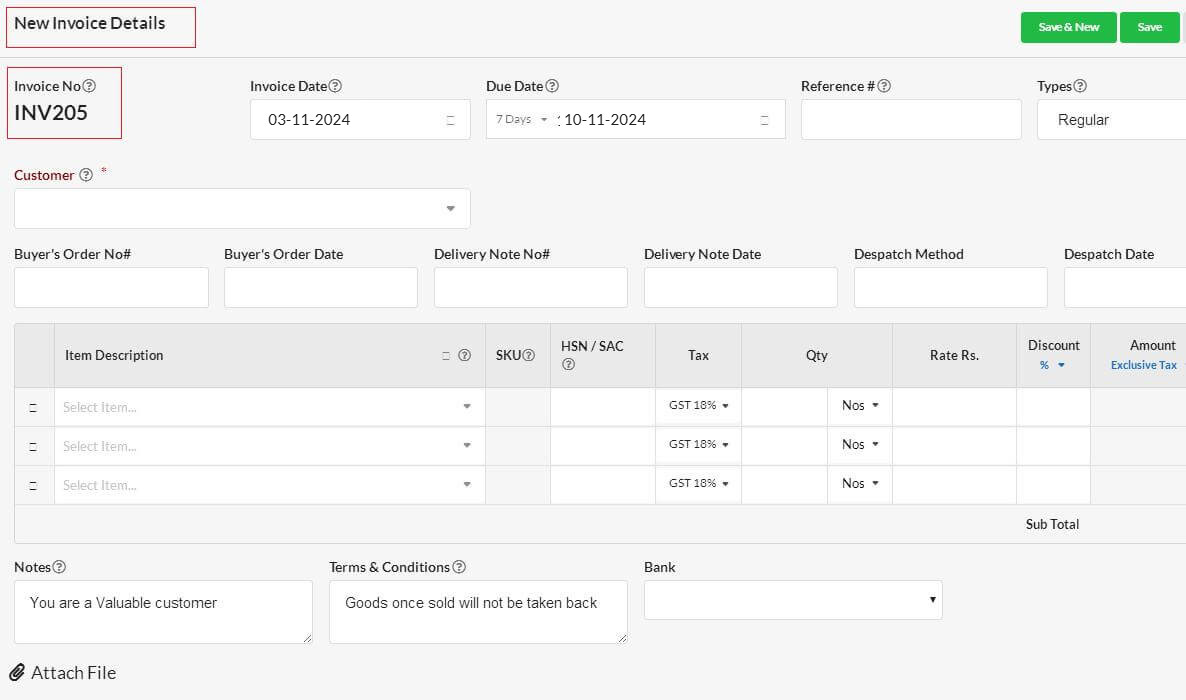

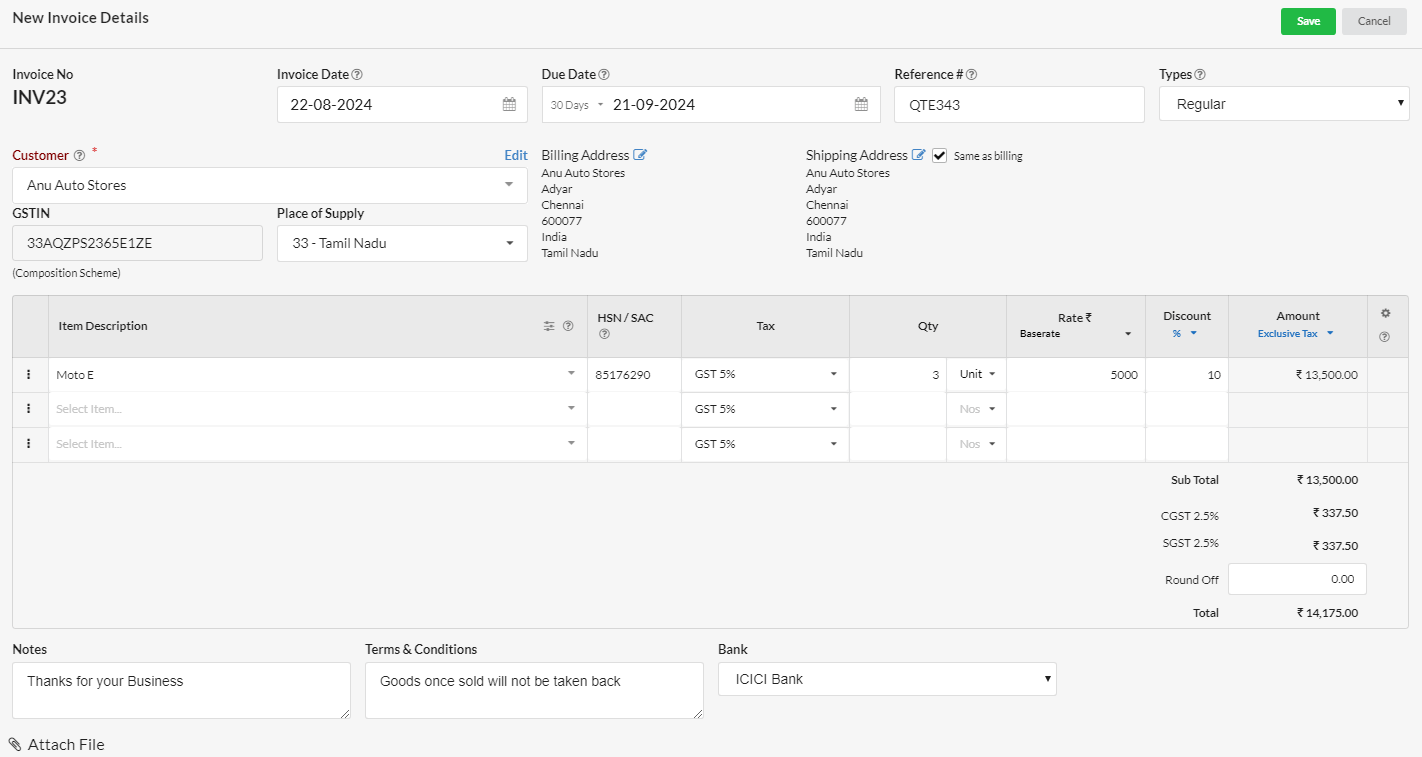

Create Invoice

To create a new invoice, you can use the Quick Start (+ icon) or short cut (Alt+i) or New Invoice button at the top-right corner in Invoice listing page. Provide the needed fields and hit Save or Save & new button.

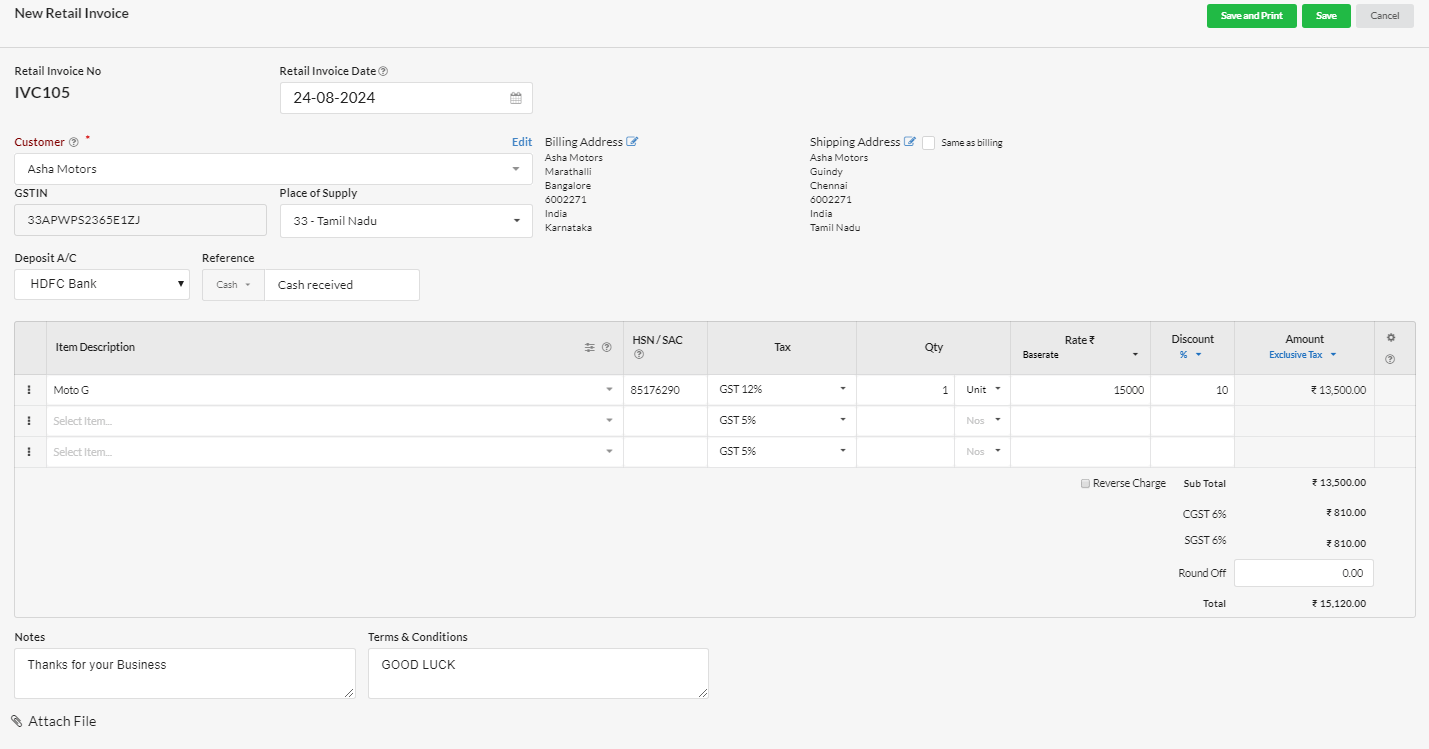

To create a Retail invoice

Click Quick Add button at top & select Retail Invoice (or) Alt +N (or) Click on Sales in left menu and select Invoices. Click on the drop down under New Invoice button and click New Retail Invoice. Provide the needed details and Click Save.

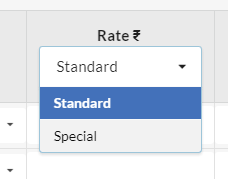

Field Description

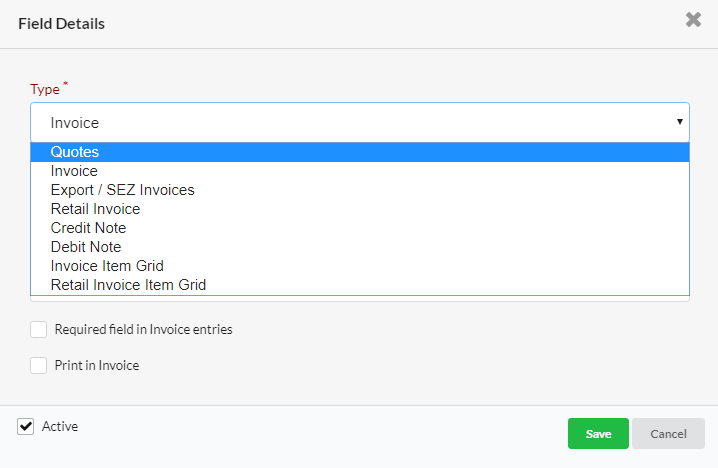

Custom Fields

You can add new custom fields to your invoice by defining in Settings > Sales > Custom fields.

The fields defined in Settings, will be displayed for input in Invoice.

The values provided in the custom field will be stored with invoice. In future, even when we remove a

custom field in settings, it can be still viewed in invoice where it was used previously.

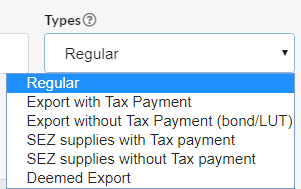

Classifications of Invoice based on GST

While filing GST Returns, an Invoice will be classified as below:

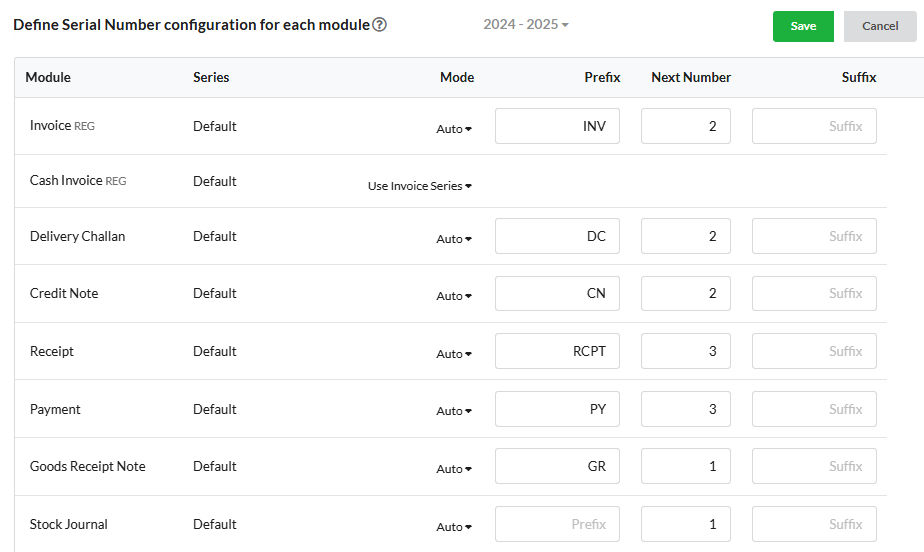

Serial Number Configuration in Invoice/Retail Invoice

Configure serial number under – Settings > Modules > Define Serial Number configuration for each module.

How to use the invoice number of deleted invoice in other invoice and make continuous sequence of invoices?

Go to Settings > Modules > Define Serial Number configuration for each module.

Enter the deleted invoice number(eg.205.) in the series start field of invoice.

Hit Save.

Then, the new invoice number will start from the number entered(eg.205).

Note

The invoice number cannot be duplicated within a financial year i.e each invoice number should be unique.

Invoice / Retail invoice in same series

You can use the series of the invoice for the retail invoice also.

So that, both invoice and retail invoice will be in the same series.

Convert Quote to Invoice

How to convert a quote directly as an invoice?

- You can convert a quote as invoice directly in Sales > Quotes page.

- Use “Create Invoice” option associated with each quotes.

- A “New Invoice Details” popup for converting the quote to invoice will appear, where you can edit and save.

- Invoice number shown will be the continuation from the previous one.

- You can edit it in Invoice menu, if invoicing number is set as Manual in Settings > Modules.

Convert Sales order to invoice

How to convert a sales order directly as an invoice?

- You can convert a Sales order as invoice directly in Sales > Sales order page.

- Use “Create Invoice” option associated with each sales order.

- A “New Invoice Details” popup for converting the sales order to invoice will appear, where you can edit and save.

- Invoice number shown will be the continuation from the previous one.

- You can edit it in Invoice menu, if invoicing number is set as Manual in Settings > Modules.

Actions that can be performed in Invoices/Retail invoices

You can make receipt directly from action option associated with each invoice.

Fully paid invoiced can’t be edited.

You can print Delivery Challan using the downward arrow associated with each grid in Action column in Retail Invoice

How to edit/delete/send/copy Invoices/Retail invoices?

Click on the drop-down associated with each invoice/retail invoice under Action category.

And, choose the desired action.