Page Contents

GSTR-1 Return Filing

GSTR-1 is a Monthly or Quarterly return that should be filed by every registered dealer. It contains details of all outward supplies i.e. sales. Every registered person is required to file GSTR-1, irrespective of whether there are any transactions during the month or not.

Exempted list from GSTR-1

The following list of registered persons are exempt from filing the return:

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR)

- Persons/Companies have to pay tax themselves (as per Section 14 of the IGST Act)

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS

How to generate GSTR-1?

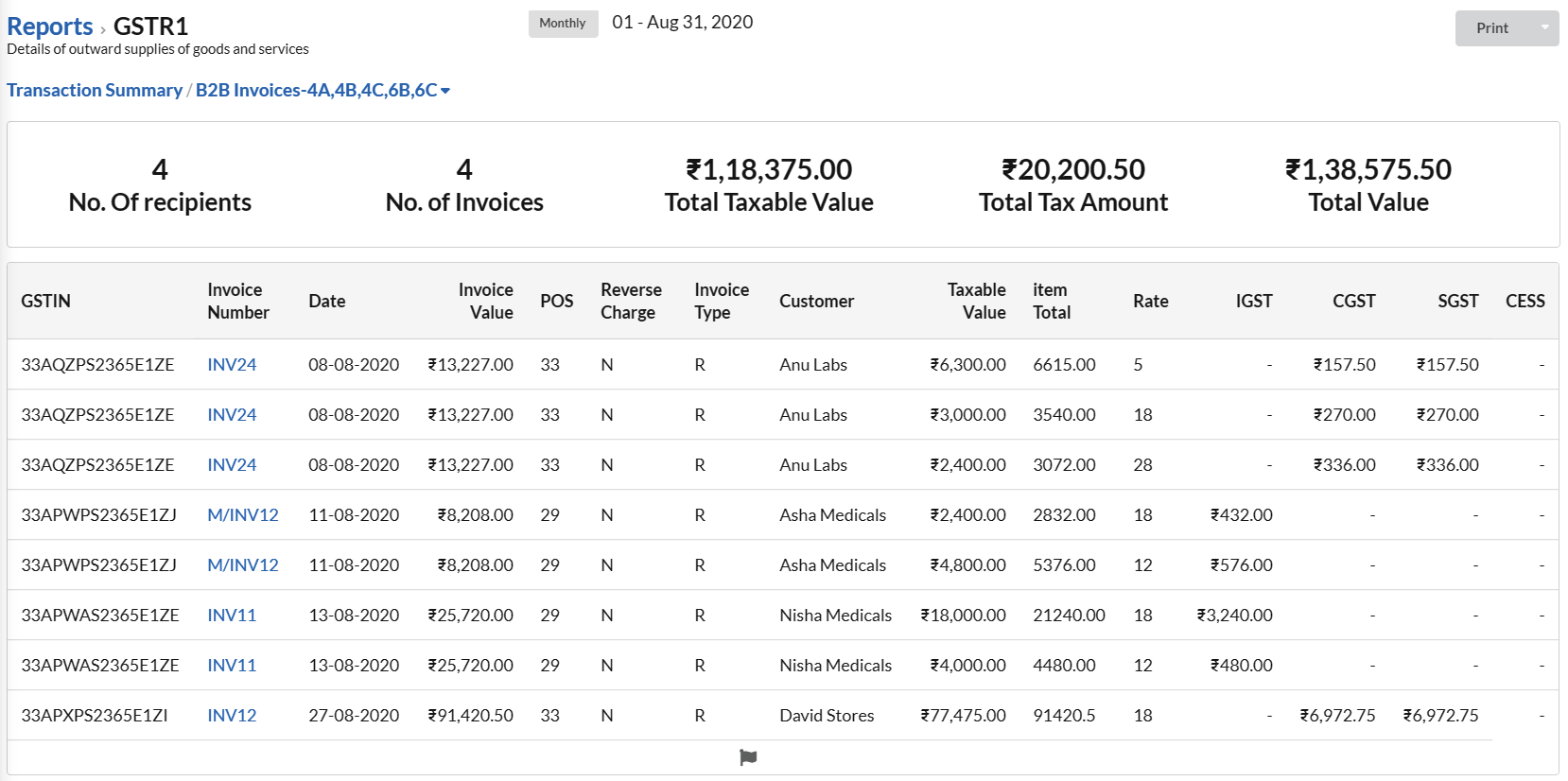

- You can find the list of details of Outward Supplies(Sales) under Reports > GSTR-1.

- Entire details of all the Sales Transaction is listed here.

Due dates

The due dates for GSTR-1 are based on your turnover.

Businesses with sales of up to Rs. 1.5 crore will have to file quarterly returns. For Example, if the Period is Apr-Jun 2018 then Due date would be 31st July 2018.

Other taxpayers with sales above Rs. 1.5 crore have to file a monthly return. For Example, if the Period is Jun 2018 then Due date would be 31st July 2018

Actions available in GSTR-1

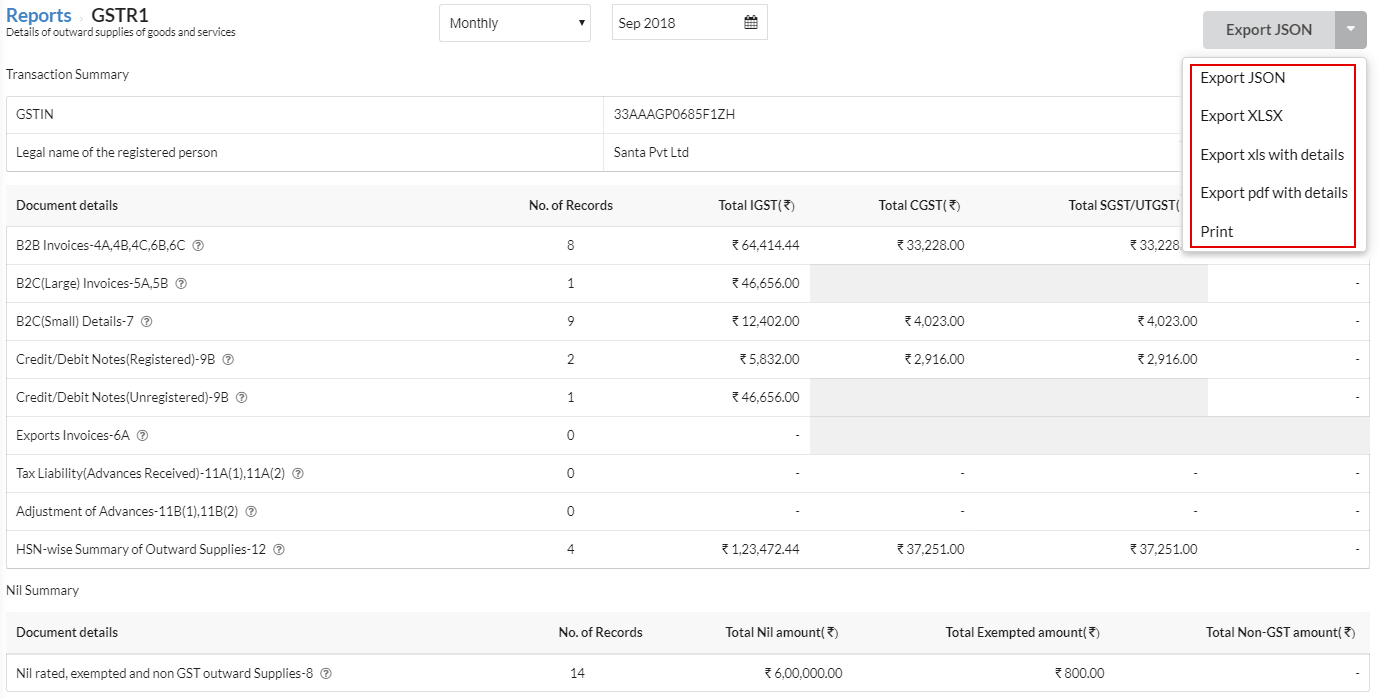

- Choose the Export JSON option from the drop-down at the right corner for saving and filing it to government tax authorities.

- Else, select the Export XLSX or Export XLS with details or Export PDF with details or Print option from the drop-down at the right corner for saving and providing it to an accountant to file to government tax authorities.

<

GSTR-1 Rectification

A return once filed cannot be revised. Any mistake made in the return can be rectified in the next periods (month/quarter) return. It means that if a mistake is made in June GSTR-1, rectification for the same can be made in July’s GSTR-1.

Late Fees and Penalty

Late Fees for not filing GSTR-1 is Rs. 200 per day of delay Rs. 100 as per CGST Act and Rs. 100 as per SGST Act. The late fees will be charged from the date after the due date. The late fees have been reduced to Rs. 50 per day and Rs 20 per day (for nil return)